Once again, Victor Davis Hanson provides a concise statement on what the Declaration of Independence meant when published on July 4, 1776. Read the whole thing over at American Greatness.

Author: TCA

America’s Left is Today’s Third Reich

We were on a family vacation in Israel recently, and as many do, we toured Yad Vashem (the Holocaust museum). As we toured the museum, the tour guide described the tactics and processes used by Hitler and his thugs in turning the people of Germany against the Jewish population. At the end of the tour, my wife and I agreed that what the guide described is what is currently being done to conservatives, Christians and any one else who does not tote the line of the left. Seeking to destroy individuals simply because they do not agree with you is the left’s game. They try and convince their followers that the reason they are so miserable is due to conservatives. Personal responsibility – out the window. Every grievance their constituents have is due to conservatives. That’s their message, and given they control the educational system in the U.S., they are able to indoctrinate children in this philosophy at an early age before their reasoning skills are developed. This ensures the minds of the children are warped, and the left’s doctrine become part of the child’s core beliefs. Once established, these core beliefs are difficult to change and set the country down a similar path to Germany in the 1930s and 1940s.

Dedollarization: The New Black Swan?

Dedollarization, i.e. the U.S. dollar’s fall from the reserve currency around the globe, is a phenomena often discussed by economists but is not well understood.

Background

The U.S. dollar has been the dominant global reserve currency for decades, enabling the United States to enjoy many economic benefits and privileges, such as lower borrowing costs, easier access to foreign goods and services, and greater influence over international trade and finance. However, in recent years, the trend of dedollarization has been gaining momentum, as more countries and entities seek to diversify their currency holdings, reduce their exposure to U.S. sanctions and political risks, and assert their own financial sovereignty. This blog post aims to explore what dedollarization means, why it matters, and how it could affect the U.S. economy.

What is Dedollarization?

Dedollarization refers to the process of reducing or eliminating the use of the U.S. dollar as a means of payment, store of value, or unit of account in international transactions. This can take various forms, such as switching to other currencies, such as the euro, yen, yuan, or digital assets; creating new regional or global currencies, such as the euro or the SDR (Special Drawing Rights) of the IMF; bartering goods or services directly without using any currency; or adopting alternative payment systems, such as blockchain-based platforms or SWIFT alternatives.

Why Does Dedollarization Matter?

Dedollarization matters for several reasons, both for the countries that initiate it and for the global economy as a whole. For the countries that seek to dedollarize, the benefits can include reduced dependence on the U.S. financial system, enhanced economic autonomy and resilience, improved access to non-U.S. markets and investments, and reduced exposure to U.S. sanctions or other forms of financial pressure. For example, Russia has been actively dedollarizing its economy since 2014, following the imposition of Western sanctions over the annexation of Crimea, by increasing its use of domestic currency, barter deals, and non-dollar trade with China and other partners.

For the global economy, dedollarization can pose some challenges and opportunities, depending on the pace, scope, and coordination of the shift. On the one hand, dedollarization can increase the volatility, uncertainty, and fragmentation of the international financial system, as different currencies and payment systems may not be fully interchangeable, may not have the same liquidity and stability as the dollar, and may face geopolitical or regulatory obstacles. On the other hand, dedollarization can also promote more diversified, inclusive, and multipolar monetary and financial arrangements, which may reduce the systemic risks and imbalances that arise from the dominance of a single currency.

How Could Dedollarization Affect the U.S. Economy?

Dedollarization could affect the U.S. economy in various ways, depending on the extent and speed of the trend, and the responses of U.S. policymakers and markets. Here are some possible scenarios and impacts:

- Reduced demand for U.S. dollar assets: If more countries and investors shift away from holding U.S. dollars, U.S. Treasury bonds, and other U.S. assets, the demand for those assets could decline, leading to higher borrowing costs, lower asset prices, and weaker fiscal and monetary positions for the U.S. government and the private sector. This could also erode the status of the U.S. dollar as the world’s reserve currency, which could make it more expensive and harder for the U.S. to finance its deficits and maintain its global influence.

- Increased inflationary pressures: If the U.S. dollar depreciates relative to other currencies or assets, the imports of goods and services could become more expensive, leading to higher inflation and reduced purchasing power for U.S. consumers and businesses. This could also put upward pressure on U.S. interest rates and reduce the attractiveness

Few are talking about it, but it is happening much quicker than people thought. Is dedollarization the next Black Swan that impacts the U.S. economy?

The Impact of Government Budget Deficits on a Country’s Economy and Poor

Federal deficits, or the amount by which government spending exceeds government revenue, can have a significant impact on a country’s economy and its poor. While deficits can be caused by a variety of factors, including recession, increased spending, or tax cuts, the consequences are often felt most strongly by those at the bottom of the economic ladder.

One of the main ways that deficits impact the poor is through inflation. When the government spends more money than it takes in, it often has to borrow money from other countries or from the public by issuing bonds. This can increase the supply of money in circulation, leading to inflation. Inflation can hurt the poor the most because they typically have less access to credit and are less likely to be able to afford the rising prices of goods and services.

Another way that deficits can hurt the poor is through higher interest rates. When the government borrows money to finance a deficit, it increases the demand for credit, which can lead to higher interest rates. This can make it more expensive for the poor to borrow money for things like education, housing, or starting a business.

Deficits can also impact the poor by crowding out government spending on social programs. When the government has to spend more money on interest payments to service its debt, it has less money to spend on programs that help the poor, such as food assistance, housing subsidies, or healthcare. This can lead to cuts in these programs or a lack of funding to address growing needs.

Finally, deficits can hurt the poor by undermining economic growth. When a country has a large deficit, investors may become less confident in its ability to pay back its debt, leading to a decline in foreign investment and a drop in economic growth. This can lead to job losses and lower wages, which disproportionately affect the poor.

In conclusion, federal deficits can have a significant impact on a country’s economy and its poor. While deficits may sometimes be necessary to stimulate growth or address emergencies, they must be carefully managed to minimize their negative effects on the most vulnerable members of society. This requires a balancing act between government spending, taxation, and borrowing, as well as a commitment to ensuring that social programs are adequately funded and targeted to those who need them most.

Waiting on the world to change

I was listening to XM yesterday, and John Mayer’s song ”Waiting on the World to Change” came on. I’ve heard the song many times, I but never really listened to the words. For some reason, I did today and found a line that puts today’s woke/misinformation world into perspective.

Whether it is COVID, J6, ESG, DE&I or the disinformation crowd, a line in the song nails it and really tells you why free speech is needed.

And when you trust your television what you get is what you got cause when they own the information oh they can bend it all they want

Isn’t that exactly what the Twitter files has shown? How about Tucker Carlson’s release of J6 videos? COVID 19? How about the entire Trump/Russia hoax?

We are failing as a country and it is the government/media symbiote that is the reason. Time to kill all of the alphabet agencies and start fresh.

Enemies of the State

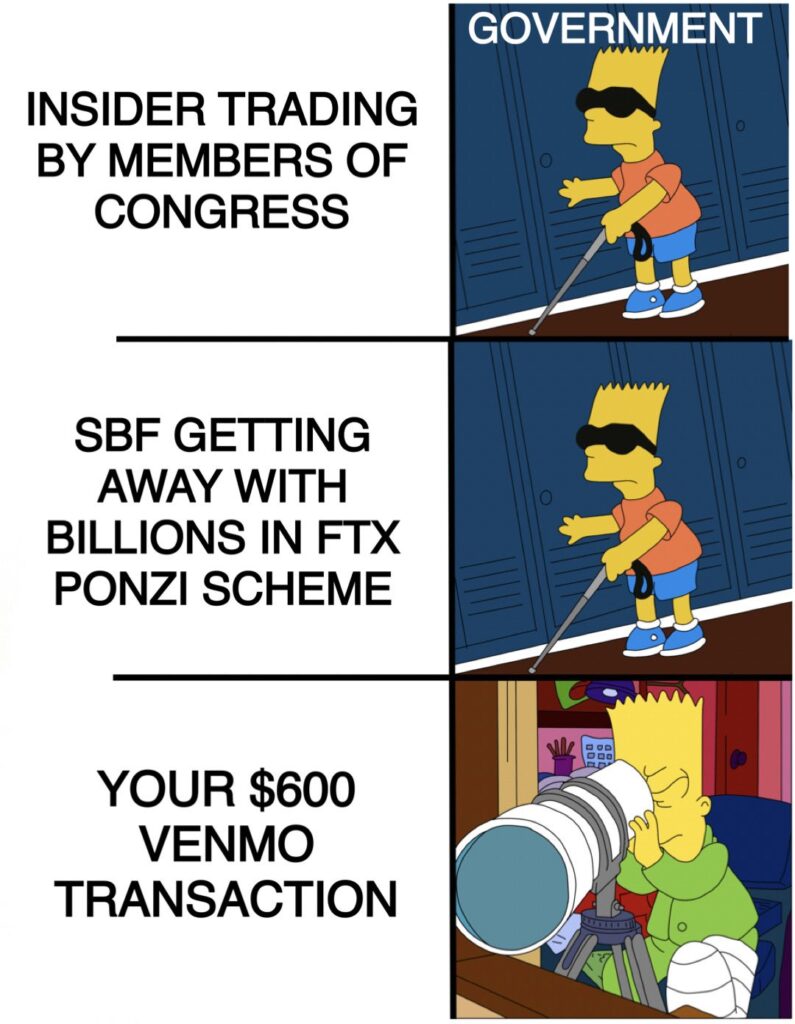

When the enemies of the state end up controlling it, the citizens of the state become the enemy. You see that today with employees of the federal government at all levels and all branches on the take from foreign governments. They receive generous salaries, pensions and benefits far exceeding those of the average citizen who is required to pay into the scheme supporting them. As Dan Bongino has demonstrated, these enemies of the state receive money from foreign governments, NGOs and big business to buy silence allowing these organizations to drive government policy in a way to keep the enemies of the state unaccountable to the citizens.

The enemies of the state currently running the country have destroyed the value of our currency and sentenced future generations to lives of poverty. The debt they accumulated will be the hangman’s noose on the future generations. They are like the aliens from Independence Day moving from one country to the next after destroying the former.

The Constitution is not a suicide pact as Rush Limbaugh used to say. At some point, the people will rise up against the state as our founders did. Freedom and limited government will once again be the rallying cry for a great nation until once again success breeds contentedness allowing the enemies of the state to once again take control.

The Biden Foreign Agent Scandal

All week on his radio show, Dan Bongino has been putting together the pieces and assembling them in a fashion that makes everything clear: Joe Biden is a forein agent. In his book Follow the Money Bongino has a chapter titled “Ensane in Ukraine” wherein he puts together the facts detailing how much money was being made by many in the establishment due to the corruption in Ukraine. Joe Biden was the point person on Ukraine for the Obama administration, and how he wanted to get in on the action. Biden’s son Hunter was given consulting/board roles from an energy company in Ukraine providing what was essentially a now-show job. Hunter got paid and would “pay” Joe completing the money trail ($50,000 for rent). Joe would lobby Obama and others for money and arms to be sent to Ukraine making Joe a foreign agent. We know this is how it work due to Hunter’s ex-partner, Tony Bobulinski, has said that “10% was for the big guy” who he said was Joe. Further, in the last days of the Obama administration, Biden went to Ukraine. Why? Because he needed to tie everything down to ensure the money continue unabated.

Didn’t we see the same thing beginning to take shape in China?

Now, we find that Biden had classified documents from when he was a senator as well as vice-president which is a violation of law. Unlike a former president, the vice president is not allowed to have those documents. The presidents determine what is classified or not, so them possessing documents post-term is not unusual. As a matter of fact, it is very usual for the Federal Archived and the former presidents to have disagreements over such documents.

Were the classified documents at the Penn Center (who received multi-millions in contributions from the Chinese Communist Party) about China allowing the Chinese (and others paying into the scheme) to see them?

Were the documents found at his homes related to Ukraine hiding his activities there?

Conclusion, our federal government is nothing but a scam filled with those on the take being protected by the deep state. This allows the money to keep rolling to them all while our liberty and freedoms are being eviscerated by them.

It is about time to rid ourselves of them all.

Dedollarization Begins In Davos

ZeroHedge has a post up discussing Zoltan Pozsar’s report discussing how Putin could destroy the Petrodollar by having everyone pay in gold. Now,

And now, according to Bloomberg, Saudi Arabia is open to discussions about trade in currencies other than the US dollar, according to the kingdom’s finance minister.

“There are no issues with discussing how we settle our trade arrangements, whether it is in the US dollar, whether it is the euro, whether it is the Saudi riyal,” Mohammed Al-Jadaan told Bloomberg TV on Tuesday in an interview in Davos.

“I don’t think we are waving away or ruling out any discussion that will help improve the trade around the world,” Al-Jadaan said.

ZeroHedge

Joel Bowman: The A-Word

Joel Bowman (via Bill Bonner’s blog)

The cost of the government far exceeds its benefit.

Your Government